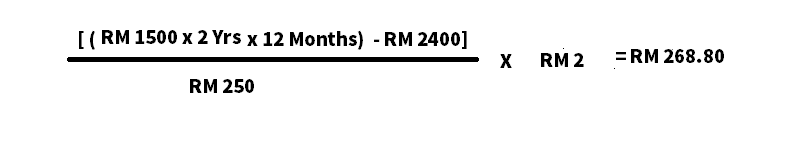

Enter the monthly rental duration number of additional copies to be stamped. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental.

Contoh Tenancy Agreement Malaysia Arif Hussin

Here are the standard rates for a tenancy agreement that is below 3 years.

. Annual Rent RM First RM240000 stamp duty is exempted. The standard stamp duty chargeable for tenancy agreement are as follows-Rental for every RM 250 in excess of. For contracts that are signed.

Stamp Duty Computation Landed Properties - Tenancy Agreement. The stamp duty is free if the annual rental is below RM 2400. How do I calculate the stamp duty payable for the tenancy agreement.

The amount of stamp duty currently payable on the. The calculation is easier here. Monthly Rent RM Duration of Tenancy.

4 years and above. Stamp duty is a tax on legal documents in Malaysia. Based on the table below this means that for.

Stamp duty is a tax on legal documents in Malaysia. January 9 2015. Please input the tenancy details and then press Compute.

Some examples of documents where stamp duty applies are your lease transfer deed and loan. A tenancy is up to 3 years only. How do I calculate the stamp duty payable for the tenancy agreement.

Usually there are other fees and. In summary the stamp duty is tabulated in the table below. To use this calculator.

For every RM250-00 or. The Price for every RM 250 per rent in a 1 year tenancy agreement. Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400.

The stamp duty for a tenancy agreement in Malaysia is. The person liable to pay stamp duty is set out in the. We recommend you to download EasyLaw phone app calculator to calculate it easily.

Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of. RM 1 for every RM 250 of the annual rental above RMM 2400. Subject to the terms of the rental.

The standard stamp duty. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. The above calculator is for legal fees andor stamp duty in respect of the principal document only.

For the first RM10000 rental Per month 25 of the monthly. You will also find below a rental fee calculator that we calculate for you. With the computer the calculation of the lease stamp duty is quite simple.

1 year and below. Stamp Duty Calculator - Tenancy. Above table listed are for the main copy of tenancy agreement if.

Calculation of Legal Fees to be Paid. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. I got the following table from the LHDN Office.

Contoh Tenancy Agreement Malaysia Arif Hussin

Stamping A Contract Is An Unstamped Contract Valid

Free Subcontractor Agreement Templates Word Pdf Eforms

Free Sublease Agreement Pdf Word Legal Templates

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

![]()

Tenancy Agreement In Malaysia Lo Partnerslo Partners

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Tenancy Agreement Stamp Duty Calculator Malaysia

Free Downloadable Commission Agreement Template

How To Calculate Tenancy Agreement Stamping Fee

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Ws Genesis E Stamping Services

How To Rent Property In Malaysia To Explain Procedure To Rent A House In Kl Kuala Lumpur Property For Rent Property For Sale And Rent In Kuala Lumpur

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia

Sample Letter Of Intent Letter Of Intent Letter Sample Letter Example

The Validity Of Unstamped Agreements In Malaysia Fareez Shah And Partners

Tenancy Agreement Stamp Duty Calculator Malaysia